Financial decisions have never been simple. From choosing the right savings plan to evaluating investment portfolios, individuals and businesses face complex choices every day. Traditional advisory services often rely solely on human expertise, which can be limited by time, bias, and access to information. Enter the AI Financial Advisor—a powerful solution that merges advanced technology with financial knowledge to create intelligent, real-time guidance.

At FIX Partner, we combine two innovative approaches—Domain-Driven Design (DDD) and Retrieval-Augmented Generation (RAG)—to build contextual AI systems that go beyond generic automation. These solutions help financial institutions deliver smarter, personalized, and trustworthy financial advisory services to their clients.

This article explores how AI financial advisors work, why context matters, and how DDD + RAG provide the foundation for meaningful, business-oriented solutions.

Understanding the AI Financial Advisor

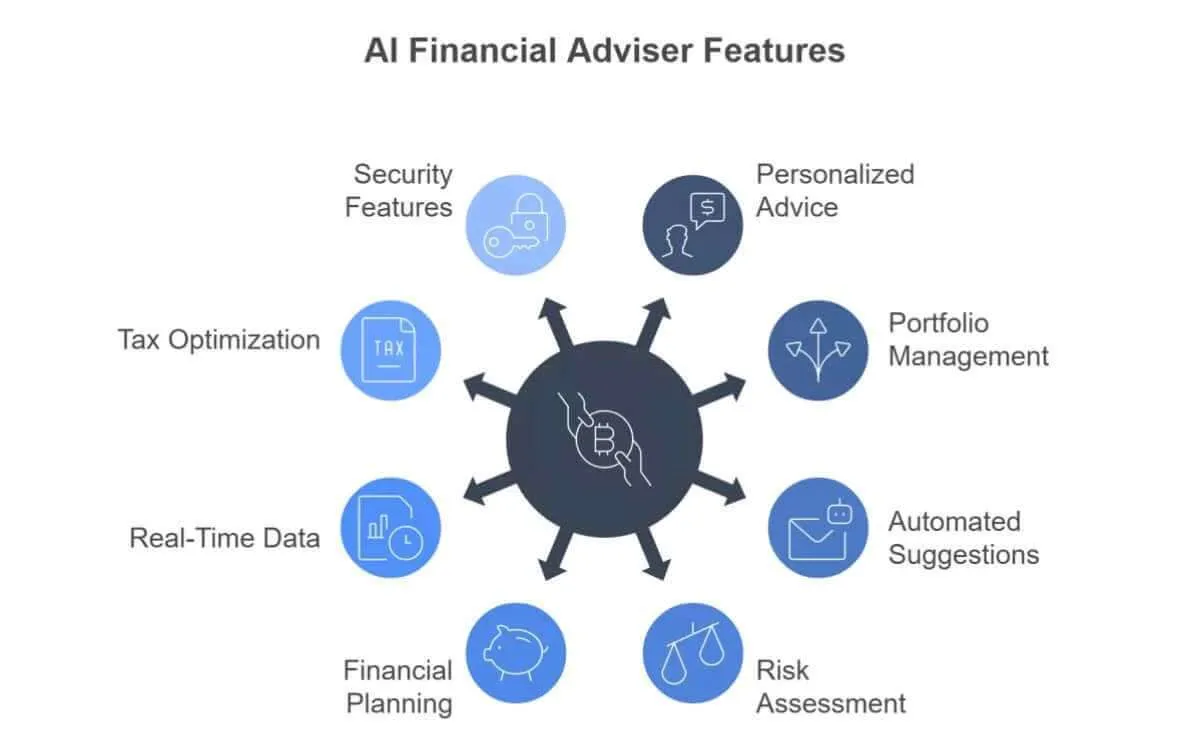

An AI Financial Advisor is not a robot sitting behind a desk but a digital system designed to analyze financial data, interpret market movements, and suggest strategies tailored to each client’s situation. Unlike simple chatbots, which respond with predefined answers, AI advisors learn from financial logic, adapt to regulatory requirements, and access the latest market insights.

For a business leader or decision-maker, this means faster access to advice without waiting for a human consultant. For customers, it ensures recommendations that are objective, consistent, and available 24/7.

Key Benefits for Businesses

- Scalability – Serve thousands of customers simultaneously without adding new staff.

- Consistency – Every client gets the same high-quality advice, aligned with business goals.

- Speed – Immediate answers reduce decision-making delays.

- Cost Efficiency – Lower operational expenses compared to manual advisory services.

Why Context Matters in Financial Advice

Financial advice is never one-size-fits-all. Two people may earn the same salary but require completely different strategies. A young entrepreneur might focus on rapid growth and high-risk opportunities, while a parent nearing retirement may prioritize security and steady income. The difference lies in context — it is what transforms numbers into meaningful, practical guidance.

Without context, advice can quickly go wrong. Imagine an AI system suggesting aggressive stock investments to someone about to retire. Or recommending ultra-conservative savings to a start-up founder chasing growth. Both pieces of advice could be technically correct, but they fail the client because they ignore real-life circumstances. Context bridges this gap, turning generic advice into a personalized strategy.

At FIX Partner, we design AI advisors that are context-aware. This means they process three critical layers:

- Domain Logic: The core rules of finance, including compliance, tax structures, and investment principles.

- User Profiles: Individual goals, risk tolerance, and behavioral patterns that shape financial decisions.

- Real-Time Data: Market movements, economic trends, and risk alerts that affect outcomes daily.

By combining these layers, we ensure financial advice is not only accurate but also relevant and actionable. Context is what helps businesses and individuals make smarter, safer, and more confident financial decisions.

The Role of Domain-Driven Design (DDD)

Domain-Driven Design (DDD) is a way of structuring software around real-world business logic. Instead of building AI systems as generic engines, DDD ensures they reflect the specific financial concepts and workflows of your institution. This makes technology more relevant, reliable, and directly tied to your strategic goals.

How DDD Helps AI Financial Advisors

- Alignment with Business Needs: AI advisors built with DDD don’t rely on generic models. They mirror the unique services, products, and priorities of your institution. For instance, a retail bank offering tailored mortgage options can ensure those exact models are embedded into the AI, so recommendations match business strategy.

- Shared Language: DDD promotes a common vocabulary between IT and business teams. This reduces costly miscommunication and ensures everyone — from developers to financial advisors — is working toward the same understanding of terms, rules, and objectives.

- Scalable Structure: As financial services grow and diversify, so must the supporting technology. DDD creates modular systems that can expand to handle new services without disrupting existing ones, maintaining accuracy and stability as you evolve.

- Trust and Compliance: Regulatory requirements and customer trust are central to finance. With DDD, compliance rules and ethical guidelines can be baked directly into the system. For example, if your bank prioritizes ethical investing, that philosophy becomes part of the AI’s decision-making process.

At FIX Partner, we apply DDD to ensure financial AI solutions are not only technically strong but also aligned with your institution’s values, strategy, and long-term growth.

The Power of Retrieval-Augmented Generation (RAG)

Retrieval-Augmented Generation (RAG) is a powerful approach that combines two strengths: retrieving accurate information from trusted sources and generating responses that feel natural and easy to understand. Instead of relying only on pre-trained knowledge, RAG grounds its answers in real-time, verified data.

- Smarter Financial Guidance: In financial services, this makes a major difference. An AI Financial Advisor powered by RAG can instantly pull the latest market reports or regulatory updates and use them to shape recommendations. This ensures advice reflects the most current conditions rather than outdated assumptions.

- Data-Backed Strategies: RAG also strengthens decision-making. For example, if a client asks about investment opportunities, the AI doesn’t just provide a generic answer. It connects to live economic data, compares options, and delivers strategies supported by evidence.

- Clear Explanations for Clients: Just as important, RAG explains its reasoning in plain language. Instead of overwhelming clients with technical jargon, it translates complex insights into terms that build confidence and trust.

- Accuracy and Credibility: By grounding responses in external knowledge, RAG minimizes the risk of “hallucinations” — the misleading answers some AI systems produce. For financial institutions, this means reliable advice, stronger compliance, and a higher level of credibility with clients.

How DDD and RAG Work Together

When Domain-Driven Design (DDD) and Retrieval-Augmented Generation (RAG) are combined, the result is an AI Financial Advisor that is both smart and reliable. Each plays a distinct role, and together they create a system that mirrors human decision-making.

- DDD = The Brain’s Logic: DDD defines the business rules and reasoning behind financial decisions. It ensures the AI reflects your institution’s values, compliance needs, and long-term strategies rather than relying on generic models.

- RAG = The Brain’s Memory: RAG supplies fresh, trustworthy information from external sources. This means up-to-date market data, economic trends, or regulatory changes back every recommendation.

The Power of Integration: With DDD setting the structure and RAG grounding advice in real-world knowledge, FIX Partner delivers AI solutions that provide context-aware, trustworthy guidance. The result is financial advice that adapts in real time while staying true to your business philosophy.

Practical Applications for Your Business

An AI Financial Advisor is more than a promising concept — it has tangible applications that directly impact how businesses serve clients and make decisions. By combining Domain-Driven Design (DDD) and Retrieval-Augmented Generation (RAG), these systems deliver personalized, trustworthy, and timely financial guidance. Let’s look at where this matters most.

1. Wealth Management

High-net-worth clients demand strategies that feel unique to them. AI can evaluate portfolio performance, assess tax implications, and analyze individual risk profiles. From there, it recommends investment opportunities in real time. This not only saves advisors hours of manual analysis but also ensures clients see advice that reflects their personal circumstances.

2. Retail Banking

For everyday customers, financial planning can feel overwhelming. AI advisors simplify the process by offering step-by-step guidance — from setting savings goals and planning for education to selecting the right loan product. The result is a more accessible, customer-friendly banking experience that builds loyalty.

3. Corporate Finance

Businesses often face complex challenges like managing cash flow, allocating capital, or hedging risks. AI-driven advisors provide timely, data-backed recommendations faster than traditional consulting teams. This agility helps businesses act quickly in volatile markets and seize opportunities before competitors do.

4. Insurance

Choosing insurance policies can be confusing. AI systems can match clients with plans that align with their health needs, family circumstances, and financial goals. By offering clarity and personalization, insurers reduce customer churn and improve satisfaction.

5. Regulatory Compliance

Financial institutions operate in heavily regulated environments. AI systems powered by DDD and RAG can continuously monitor regulatory updates, automatically adjust advice, and document compliance. This reduces risk while giving both institutions and clients confidence in every decision.

How FIX Partner Can Help Build Trusted AI Solutions

Many business leaders hesitate to embrace AI because of concerns about complexity, cost, or reliability. At FIX Partner, we believe these challenges can be turned into opportunities when approached the right way.

- Tackling Complexity: AI doesn’t have to be overwhelming. Using Domain-Driven Design (DDD), we build solutions that reflect your business model. This means systems feel intuitive and natural to your teams because they follow the same workflows you already use.

- Managing Costs Wisely: AI should be seen as a long-term investment. By automating repetitive tasks like compliance checks, reporting, or portfolio monitoring, AI reduces operational overhead. This efficiency frees your staff to focus on higher-value work, creating savings that far exceed the initial investment.

- Ensuring Reliability: Accuracy is essential in financial services. With Retrieval-Augmented Generation (RAG), every AI recommendation is grounded in verified, up-to-date information. This dramatically lowers the risk of errors while increasing trust among clients and regulators.

- Keeping the Human Touch: AI is not here to replace human advisors — it enhances them. By handling routine analysis, AI gives professionals the space to focus on strategy, client relationships, and personalized advice. The result is a stronger, more human customer experience.

The FIX Partner Advantage

At FIX Partner, we bring together DDD and RAG to deliver AI solutions that are context-aware, trustworthy, and scalable. Our approach includes:

- Expertise in DDD + RAG – Combining business logic with advanced AI methods.

- Tailored Solutions – Customized for your institution’s goals and customers.

- Scalable Platforms – Designed to evolve with your growth.

- Commitment to Trust – Aligned with compliance and ethical standards.

With FIX Partner, AI becomes a reliable growth driver — practical, cost-effective, and built around your business.

Conclusion

The financial sector is evolving rapidly, and businesses that embrace intelligent, context-aware systems will lead the way. An AI Financial Advisor powered by DDD + RAG delivers more than efficiency—it provides clarity, trust, and value for every client interaction.

By working with FIX Partner, your business can unlock smarter decision-making, reduce operational costs, and provide customers with the personalized financial guidance they expect. The future of financial advice is not just digital—it is contextual, intelligent, and built around your business needs.